The last time that US chip companies came cap in hand to Washington, in the mid-1980s, they were reeling from an onslaught from Japan.

A public-private partnership to develop cutting edge manufacturing technology was one result, helping to put the US back on track in an industry it had pioneered.

By comparison, American companies now dominate many parts of the global chip industry.

They account for around half of the world’s chip sales, while US equipment makers are behind much of the complex technology used to design and manufacture chips. That has left the US with a choke hold over the global electronics industry, enabling it to threaten serious damage to Huawei and other Chinese companies it views as hostile.

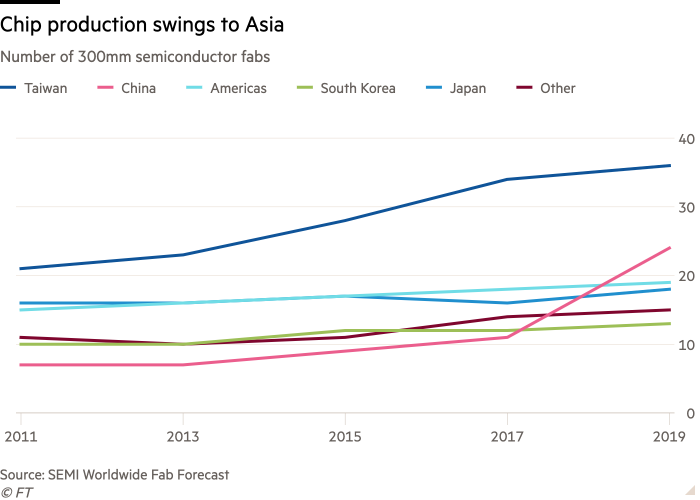

Yet that has not prevented rising worries in Washington over a looming vulnerability, as trade tensions rise, as well as industry calls for billions of dollars of taxpayer support. Many advanced chips are designed in the US, but only around 12 per cent are manufactured there.

The gap has left politicians more concerned than they were about competition with Japan, said Dan Hutcheson, chairman of VSLI Research and a longtime chip analyst. “Finally, the US has decided to assert itself,” he said.

There is no mystery behind the anxiety. China is still years behind the US in semiconductors, but it is racing to develop a globally competitive chip industry and is projected to become a serious competitor by the end of the decade.

Rising tensions with China have also underlined the potential weakness stemming from US dependence on other Asian countries to make its chips. At the centre is Taiwan’s TSMC, a “foundry”, or pure manufacturing company, which makes chips for US concerns like Nvidia, Qualcomm and AMD.

“Taiwan’s ‘silicon shield’ makes it the 51st [US] state,” said Mr Hutcheson, referring to the theory that the country’s leadership in chip technology is its best defence against aggression from China. “The US needs to protect Taiwan — it can’t afford to lose it to China.”

The rising tension in the electronics industry has served as “a wake-up call”, even if there is no immediate need for taxpayer support, added Sean Randolph, senior director at the Bay Area Council Economic Institute. “Global supply chains seem to be tightening, particularly in critical or strategic technologies, and chips are at or near the top of that list,” he said.

Intel’s slip

As if to underline the growing precariousness of America’s silicon dependence, Intel — long the symbol of the country’s leadership in chip production — shocked the industry with the disclosure that it had fallen a full year behind schedule in the process technology needed to make its next generation of chips. The slip has forced it to look into contracting out its most advanced manufacturing, with TSMC the only company to have mastered the necessary technology.

Intel’s slip came just as the US Senate and House of Representatives were converging around a bill that would pour taxpayer money into domestic chip production. The final bill lays out a framework for $25bn worth of direct incentives to stimulate investment in manufacturing capacity, along with advanced research.

The final legislation stops short of directly earmarking the money required, leaving the funding of the plan dependent on future political agreement. But powerful backers like Texas Republican John Cornyn and New York Democrat Chuck Schumer — both senators from states with significant chip manufacturing — give the subsidies a good chance of seeing the light of day, the legislation’s supporters claim.

Chip industry executives say subsidies offered by other countries have eroded the attractions of investing in chip making in the US. Global Foundries, a US foundry business backed by Abu Dhabi, last year agreed to sell one of its main US plants — known in the industry as fabs — in East Fishkill, New York that was once the flagship in IBM’s chipmaking empire, before that company quit the industry.

With US taxpayer support for future expansion, “we could do it in a more accelerated way, and do it in the US,” said Thomas Caulfield, the company’s chief executive. Subsidies to cover 20 per cent to 30 per cent of the cost is needed to make US investment worthwhile, he suggested.

Weapons systems

The most advanced plants based on the latest process technology cost more than $15bn to build, making the race to stay on the leading edge of chipmaking an increasingly narrow one. But an estimated 70-75 per cent of chips are made on older production lines operated by companies like Global Foundries.

Older chip manufacturing technologies also play an important part in national security — a key reason for the US push for more local manufacturing. Many weapons systems rely on chips that come from small production runs and older designs, prompting the Pentagon to search for more local suppliers.

They include SkyWater Technology, which owns a single chip plant in Minnesota with a production line dating back 20 years. Last year, the company received a $140m investment from the Pentagon, as well as research funding from the Darpa defence search agency.

200,000 wafers a month, capacity at TSMC Arizona fab

Combining cutting edge new technologies with the company’s older — and fully depreciated — production line could drastically bring down the cost of new chip designs, said Thomas Sonderman, chief executive officer. “There are a lot of fabs in the US that can be expanded as we did,” he added. “There’s clearly a need for a much stronger national investment in semiconductor technology.”

Staying competitive in the highest-volume parts of the electronics industry, though, will also take big bets on more advanced manufacturing technology.

Incentives have already having some effect. In May, TSMC announced plans to build a fab in Arizona, adding to an existing and smaller facility in Oregon, with unspecified state and federal government support. Samsung already has an advanced chip plant in Austin, Texas, ensuring local supply of its chips for big customers like Apple.

Daily newsletter

#techFT brings you news, comment and analysis on the big companies, technologies and issues shaping this fastest moving of sectors from specialists based around the world. Click here to get #techFT in your inbox.

Those toeholds have raised hopes in some quarters in Washington that a new manufacturing base is starting to form — though it is still a far cry from the far bigger investments in Asia, and will also depend on federal and state incentives.

At 20,000 wafers a month, the planned capacity of TSMC’s fab in Arizona is small relative to its biggest plants in Taiwan, leading some rivals to claim the investment has been offered mainly to curry favour in Washington. Even if it follows through with later expansion, it would take many years to replicate the advanced technology the company has developed in Taiwan, according to industry executives.

The prospect of only limited involvement from the Taiwanese and South Korean manufacturers means the US administration may feel it has no choice but to back Intel as a national champion, said one industry in Washington. But after the California company’s latest manufacturing stumble, anxiety is likely to remain high.

The Link LonkAugust 03, 2020 at 11:01AM

https://ift.tt/3k4iBZT

US chip industry plots route back to homegrown production - Financial Times

https://ift.tt/2RGyUAH

Chips

No comments:

Post a Comment