With the help of new products and a recent acquisition, Silicon Labs (SLAB) - Get Report is uniquely well-positioned in the fast-growing market for IoT wireless connectivity chips, its CEO argues.

Like rivals such as NXP Semiconductors (NXPI) - Get Report, Analog Devices (ADI) - Get Report and Infineon, Silicon Labs has a pretty diverse product line. Along with wireless connectivity chips, the company sells (among other things) radio chips, standalone microcontrollers (MCUs), sensors, power management ICs and signal timing and isolation chips.

But unlike many of its rivals, Silicon Labs doesn’t own chip manufacturing plants. Rather, it relies entirely on foundries such as Taiwan Semiconductor (TSM) - Get Report to manufacture its chip designs.

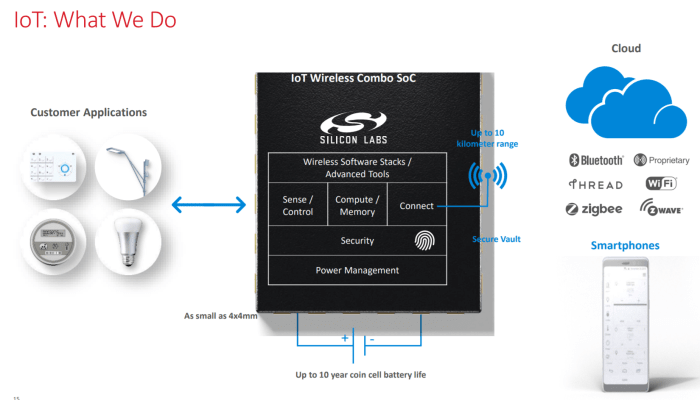

Earlier this week, in tandem with the start of a developer conference focused on the company’s IoT/smart home offerings and partnerships, Silicon Labs unveiled the BGM220S, a new Bluetooth offering for IoT devices that’s promised to deliver up to 10 years of battery life from a coin cell battery. The company also refreshed its Simplicity Studio developer tools for creating IoT devices relying on Silicon Labs’ MCUs and wireless SoCs.

The announcements follow the early-2020 launch of a low-power Bluetooth system-on-chip (SoC) known as the BG22, as well as a $308 million deal to buy chip developer Redpine Signals’ Wi-Fi/Bluetooth chip business. The Redpine deal strengthens Silicon Labs’ hand in the hotly-competitive market for Wi-Fi-capable IoT solutions.

I recently talked once again with Silicon Labs CEO Tyson Tuttle (a 2019 interview can be found here). Here’s what he had to share about various subjects of interest, slightly edited for clarity.

What the current demand environment looks like for Silicon Labs, and whether there have been any changes since it reported earnings in late July.

“We haven't updated our guidance from...when we reported earnings. That being said, we saw an improving environment as we managed through Q2. And [continuing] into Q3 in terms of bookings strength and China coming back online, [with] particular strength in a lot of the IoT, connected device stuff.”

“There was a very strong 5G infrastructure business in Q2, and [we’ve seen] that take a little bit of a pause...there was some order-ahead from some of the China customers in general and so we had guided that to be down a little bit.”

“In Q2, certainly a lot of the automotive stuff was [at] a bit of a standstill, and we saw that coming back online as we head into the second half...Overall, we see an improving environment in terms of demand, mostly across the board, especially as we look into a lot of the IoT applications.”

Silicon Labs’ plans for using Redpine’s Wi-Fi and Bluetooth IP within its product line, and if there are end-markets where it could be particularly useful.

“We're very excited about Redpine and bringing Wi-Fi into the portfolio. Redpine came in with a very strong Wi-Fi 4 SoC that had significant traction in the market, and we've been able to generate about $500 million [of lifetime revenue opportunities] as of the last time we talked about it...That's in a lot of smart home applications, some industrial lighting, some of the voice assistants and things like that. Wi-Fi is a key connectivity technology to connect devices into networks, and we're very excited about the team that came on board in Hyderabad, India. And [we’re] in the process of both integrating their products and people into our company, but then also driving the roadmap.”

“Wi-Fi 6...has a lot of optimization for bandwidth, but [what’s] especially relevant to our markets [is the ability] to connect more and more IoT devices... And a lot of the differentiation [for Silicon Labs’ products] is that they have industry-leading power consumption....For instance, in a smart lock or in a smartwatch, you can get two to three times the battery life using the Redpine or the Silicon Labs solution, as opposed to other solutions.

“Wi Fi is just another one of the key IoT wireless technologies. We’ve got a leading position now in Z-Wave, ZigBee, Thread [and] a lot of the proprietary technologies used in industrial networks, but then also Bluetooth and Wi Fi. [For] Bluetooth we launched our BG22 [SoC] earlier in the year, and have had a tremendous reception [for] that. It's an industry-leading part [in terms of] power consumption and integration and cost. And then with Wi-Fi coming in with Redpine, that really completes our suite [of] wireless technologies focused on the local area networks and the personal area networks...and being able to mix and match those technologies for the appropriate application is really, really exciting.”

What Silicon Labs Sees as its Biggest Competitive Strengths in the IoT connectivity chip market relative to rivals such as Qualcomm (QCOM) - Get Report, NXP and Infineon.

“I think that certainly the power consumption is a key [strength], the level of integration in [our] SoC is industry-leading in terms of the processing power and feature set. But then it's also the combination of all the different wireless technologies that we have, with Bluetooth and Z-Wave and ZigBee. In other words, we're kind of a one-stop shop...being able to address all of those different standards for the different applications is something that's unique in the industry.

“I would also say the fact that...from an application developer standpoint, as we integrate the software stacks and tool suites together, users will be able to use the same sort of software framework across those wireless standards and applications as well. So being able to standardize on the software and the hardware platform across protocols that have, you know, integrated Security, high levels of integration, and industry leading power consumption. With that integration comes [a] cost advantage for the overall system.”

“If you look at a mobile phone, you've got an application processor and you've got wireless connectivity that connects to it. And that's what most of the competitors are really optimized around. If you look at MediaTek or Qualcomm....even with a lot of what Cypress bought from Broadcom and is now a part of Infineon, those are really cell phone combo chips that are just redeployed into IoT applications, and those would typically have an application processor.

“And so these are higher end type applications, but when you're talking about full integration for something like a lock or an appliance, or something where you really just need to connect in and get data back and forth. Those are usually embedded applications, and that's where we're really focused in and differentiating versus the competition.

“TI has been kind of backing out of this market a bit...Cypress has got a pretty good position with multi-chip solutions, you've got a company in China called Espressif which has done a pretty good job, and we're going to be going after them very, very aggressively...Last week, we announced a partnership with Tuya for [smart lock] applications.”

“Those types of applications are really, really exciting. It's a very very broad market, with a lot of different applications and...in that embedded space where you've got Wi-Fi and the integration of the microcontroller, all together, that's where we have a really unique solution with good integration and power consumption. And then that roadmap to Wi-Fi 6 will be very, very compelling.”

The demand boost Silicon Labs has seen in recent months within end-markets such as medical devices and solutions for industrial and retail automation, and the growth potential of the IoT connectivity market.

“If you look at our IoT business, we've shipped about 4 billion wireless chips to date, across a lot of different applications...smart home, smart cities, smart retail, industrial-type applications. And certainly through the pandemic, we have seen an acceleration [for] a lot of connected-device applications. You mentioned medical, things like pulse oximeters and blood glucose monitors, anything that can abstract the doctor from the patient and provide data is seeing a lot of momentum…[For] personal medical-type devices, we've seen the acceleration of designs and of revenue in that area. We don't break that out specifically, but it's not an insignificant number.”

“You've got a lot of the smart home applications, [where] a lot of people are home and doing upgrades...you've got security systems, you've got smart lighting and things like that [are] still getting very strong consumer demand. And then certainly smart retail things like shelf labels, is a particular area that is seeing momentum. We talked about the metering market, so smart meters getting deployed, that took a little bit of a pause and is now really coming back very strong.

“And these are all examples of things where you're getting productivity enhancements or you're enhancing security or enhancing convenience or safety, and that trend I think has only accelerated as a result of the pandemic. We've got a #1 market share in IoT, not in Wi-Fi but in the other IoT wireless technologies. We're gaining share on the Bluetooth side and [are] certainly going to be gaining share on the Wi-Fi side.”

“I think if you look at just what the size of that opportunity and IoT is...there were 22 billion wireless devices shipped in 2018. That's projected to grow to like 50 billion units a year by 2030. And this is just a steady growth of things getting connected, things having to get smarter, virtualizing [the] experience...And so the market [compound annual growth rate] is about 25%, if you take [it] from here and go out 5-to-7 years.”

The impact of Huawei sanctions on Silicon Labs’ sales of timing chips for 5G base stations -- an end-market that the company has highlighted as a growth driver over the next few years.

“Huawei, with the export ban getting tightened up, is certainly having an impact. The good thing for us is that Huawei is only about 2% of our revenue...you can make that up in other places. But certainly on the 5G rollout, they've built up some stock and they'll continue to ship, but that's going to have a major impact on their ability to continue to go there.”

“We'll see where all [this] goes from a geopolitical standpoint, but [there] seems to be fairly strong bipartisan support for pressure on Huawei. That being said, if you look over the next few years, 5G is going to [see a] big rollout and that share is going to move to other players and other regions, and so we're still quite bullish on 5G, but there's certainly going to be some delay on the 5G rollouts as a result of the U.S. policy there.”

Silicon Labs’ growth opportunities within the timing and isolation chip markets.

“If you look at data centers, we've got a couple of plays. We play in the networking side with our timing devices, and that certainly has been a bright spot this year....the capex there has been pretty strong. That's a smaller portion of our timing business...the biggest segment there is the longer-range communications stuff. And that has been mixed, but it’s actually holding in pretty well. And then you've got data centers and 5G being emerging markets for us, and then automotive being a fourth [market], which is still nascent on the timing [chip] side.”

“The big growth vector [for signal isolation chips] is really automotive. So all the electric vehicles, things like battery monitoring systems and onboard chargers, and then the motor controls that go into the electric vehicles. And we’re designed into not just the top vendors today, but a number of the tier-1 vendors that are developing new platforms there. So we see electric vehicles as being a tremendous opportunity for us for isolation, and that business is pretty solid. EVs have done pretty well compared to other automotive platforms, and [we] see continuing strength as we go into next year and the following years, as the number of electric vehicles continues to scale.

“Outside of that, you've got a lot of applications and industrial automation, you've got a lot of...high-performance power supplies and industrial motor controls. There's also a big opportunity in solar, in the solar panels and the inverters that go along with solar panel installations. And that's actually been doing pretty well too...I think that people are looking at their electric bills and seeing that solar systems are an attractive investment.”

The competitive strengths of Silicon Labs’ isolation offerings for electric cars, and how large it thinks this business could become.

“Certainly the performance and robustness of our isolation technology compared to both the analog isolators and the competition [is an advantage]. You've got companies like TI and ADI...We were first to market with this type of technology and we’ve been working on it for 15 years, so we've been able to wring out the challenges with it and also build a pretty significant portfolio that we continue to invest and expand to optimize it for a lot of the different use cases. In terms of safety…[or] the controls that are needed in the automotive environment in particular.

“So, if you look at the size of the market...let's call it 100 million units. And EVs are a small single-digit percentage of that market today. And the content per EV [for isolation] is anywhere from $30 to $50. So, you know if we're talking...a million cars, you're talking about $30 to $50 million of revenue. [As] that number starts to turn into double-digits, you're talking about a total available market of $500 million dollars or more.

“Maybe that dollar content per car gets optimized down, but you're still talking about hundreds of millions of dollars of opportunity where today we've got, call it $10 million of opportunity. So we've got [significant growth] in the EV [market] in terms of the [compound annual growth rate], and that can start to turn significant growth for us as the EV market grows. Tesla's (TSLA) - Get Report a customer, [so is] BYD over in China, and [so are] a number of other tier-1 brands that have been adopting our technology. We've had a lot of success in EVs.”

Whether Silicon Labs, which has mentioned having stretched lead times for some products, is seeing customers hold more inventory than usual.

“I think that the inventory build has mostly been a little bit in China, and mostly restricted to a smaller number of customers. I think actually the supply chain is pretty well-balanced right now in terms of days of inventory, both at customers and in the distribution channel.

“And we've been able to navigate the pandemic quite well in terms of the supply chain. We use mostly TSMC in Taiwan. And then [chip packaging and testing occurs in] South Korea and Taiwan. And so while we do some manufacturing in China, not very much. And that actually has been very stable. And then in a few areas like Malaysia and the Philippines we've had...some near term challenges in terms of supply, but those have been very isolated, and we've been able to bring those [suppliers] back online.

“So overall, the supply chain has performed quite well. The mix has changed a little bit as we've gone through the pandemic, and we've been able to respond to that...Because we're a fabless company we tend to have tighter cycle times [for] our inventory, within our supply chain. So overall I think that things are actually pretty balanced right now. I don't think that we've got an [excess] inventory situation.”

September 12, 2020 at 07:00PM

https://ift.tt/2RmoaWu

Silicon Labs' CEO: We're a One-Stop Shop for Wireless IoT Chips - TheStreet

https://ift.tt/2RGyUAH

Chips

No comments:

Post a Comment