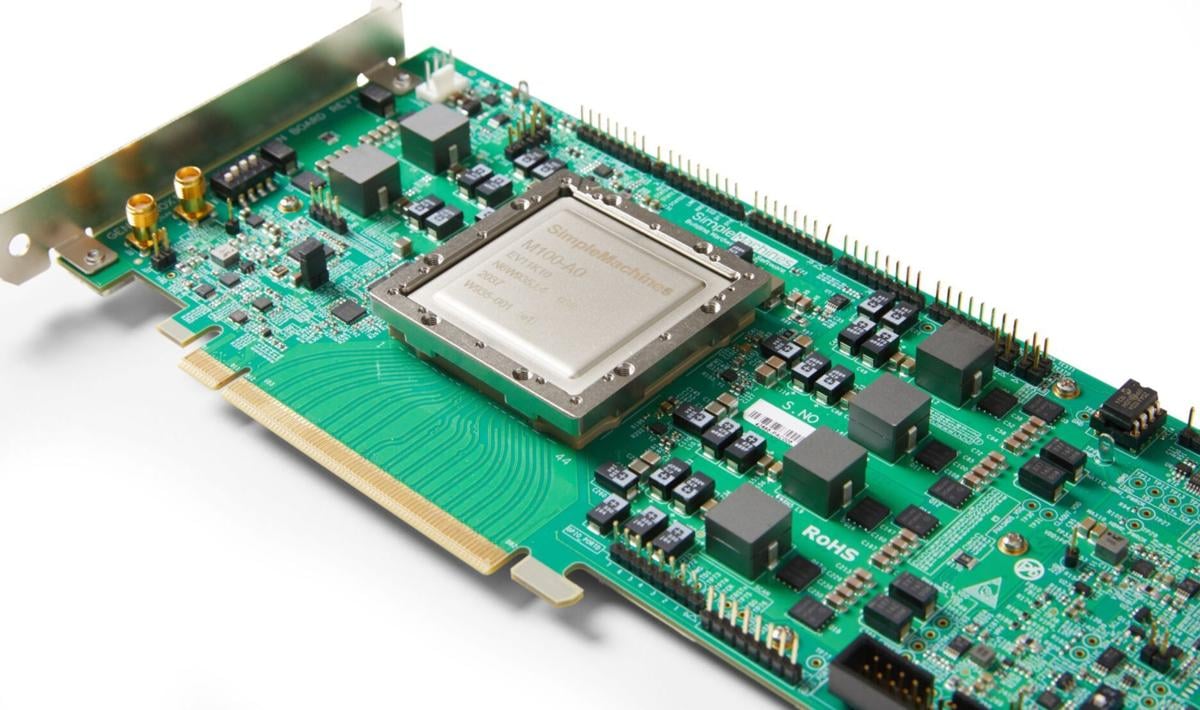

SimpleMachines' computer chip may not look all that different from what already exists in many computers, but the company's founder said the technology has the potential to speed up advancements in software development.

A Madison-based startup says its new technology could revolutionize computer programming and advance development of artificial intelligence and machine learning.

Founded in 2017 by UW-Madison researcher Karu Sankaralingam, SimpleMachines Inc. is ready to launch a new type of computer chip that Sankaralingam said is faster and more powerful than currently available chips while using less electricity.

Launching sales early next year with about 300 manufactured computer chips — called Mozart — SimpleMachines will begin working with customers — primarily companies with large data centers, such as banks — to adopt the new computer chip.

Sankaralingam said the chip has the potential to speed up development of artificial intelligence and machine learning, which has been hindered by hardware that can’t keep up.

“These things are changing very, very fast, and having a hardware solution that provides high performance and still supports that pace of evolution is very important,” Sankaralingam said.

Chips are at the core of what any computer does. Electronics from calculators to cell phones to cloud-computing servers are able to function because of the chips they use. Many chips are built for specific purposes — such as those in calculators or cameras — while others — such as cell phones and personal computers — are built to run many applications.

SimpleMachines’ chips have the potential to replace most other chips, Sankaralingam said, because it is more powerful and can be reprogrammed for new uses.

Sankaralingam launched SimpleMachines as computer chip development hit a roadblock — it was becoming harder to make better chips at a cheaper rate that were also energy efficient. While that was becoming more difficult, artificial intelligence and machine learning was advancing at rapid speed.

Artificial intelligence and machine learning need to process mass amounts of data and run many programs at one time, but Sankaralingam said many computer chips aren’t up to the task, either because they aren’t powerful enough or they use too much electricity to be cost efficient.

“That was really an opportunity for us,” Sankaralingam said. “We can strike when it’s really hot right now.”

The SimpleMachines chip addresses all those problems, Sankaralingam said. A single chip can run more programs at the same time and process data faster than other chips while also using less energy.

Though they can be built to run on less power, SimpleMachines designed this first chip to run on 75 Watts, which is the standard for most of the current machines processing massive amounts of data.

Into the cloud

The chips aren’t likely to find their way into your home computer anytime soon. Instead, SimpleMachines hopes to sell the chips to the companies doing the cloud computing that supports many aspects of online life, such as image recognition or video recommendations.

Every year, as new tech comes along, electronic devices become obsolete because the devices’ chips were developed for only one task or application. The speed that software programs evolve far outpaces the speed of hardware development.

“These applications are changing every six months, but it takes two to three years to build a chip,” Sankaralingam said. “It’s like, ‘I want to build something to do this,’ but one year later than thing is not important anymore. The chip you built is kind of useless.”

50 employees

Take GPS systems such as Garmin devices, for example. Those systems were a revolution for navigating in a car, but now, smartphones can run a GPS app well enough for most drivers.

Those years-old GPS devices are no longer useful because the chip inside can only run mapping and navigational software. But if a chip like the ones made by SimpleMachines existed, Sankaralingam said it could be reprogrammed with a software update to do other things, like become a screen for backseat passengers to watch movies.

In the three years since the company’s founding, it has grown to about 50 employees, many of whom are based in Madison or California. Among the ranks, Sankaralingam said, are a few engineers who formerly worked for computer-chip giants Qualcomm and Intel.

SimpleMachines will still have to compete with those computer-chip giants, but Sankaralingam is optimistic businesses will be willing to adopt this new chip.

No. 8: Michael Norregaard, Sonic Foundry, $262,746

Base salary: $250,916

All other compensation: $11,848

Norregaard took over as CEO when Gary R. Weis retired in May, 2019.

Weis' base salary: $402,343

All other compensation: $5,169

Weis' total compensation from Sonic Foundry in 2019: $407,512

Compensation data was collected from SEC filing 10 A/K submitted by the company in January 2020.

No. 7: Stephen L. Schlecht, Duluth Holdings, $316,211

Base salary: $316,211

No other compensation for Schlecht from Duluth Holdings is listed on SEC filing DEF 14A, submitted by the company in April. Schlecht is listed as the chairman and founder of Duluth Holdings on the company website. He took over as CEO when Stephanie L. Pugliese resigned in August 2019.

Pugliese's base salary: $450,795

Stock/option awards: $975,005

Pugliese's total compensation from Duluth Holdings in 2019: $1,425,800

No. 6: Corey A. Chambas, First Business Financial Services, $1,231,746

Base salary: $466,000

Stock/option awards: $276,879

All other compensation: $488,867

Compensation data was collected from SEC filing DEF 14A submitted by the company in March 2020.

No. 5: Jeffrey M. Keebler, MGE Energy, $2,381,012

Base salary: $591,667

Stock/option awards: $345,015

Bonus pay: $412,425

All other compensation: $1,031,905

Compensation data was collected from SEC filing DEF 14A submitted by the company in March 2020.

No. 4: Jerome Griffith, Lands' End, $5,414,578

Base salary: $1,019,231

Stock/option awards: $2,309,982

All other compensation: $2,085,365

Compensation data was collected from SEC filing DEF 14A submitted by the company in March 2020.

No. 3: John O. Larsen, Alliant Energy Corp, $7,619,999

Base salary: $754,615

Stock/option awards: $2,473,403

All other compensation: $4,391,981

Larsen took over as CEO for Alliant Energy Corp when Patricia L. Kampling retired from the company in July 2019.

Kampling's base salary: $643,468

Stock/option awards: $3,464,092

All other compensation: $1,400,554

Kampling's total compensation from Alliant Energy Corp in 2019: $5,508,114

Compensation data was collected from SEC filing DEF 14A submitted by the company in April 2020.

No. 2: Kevin T. Conroy, Exact Sciences Corp, $18,716,543

Base salary: $792,169

Stock/option awards: $16,898,172

Bonus pay: $1,000,250

All other compensation: $25,952

Compensation data was collected from SEC filing DEF 14A submitted by the company in April 2020.

No. 1: David M. Maura, Spectrum Brands Holdings, $19,688,122

Base salary: $900,000

Stock/option awards: $12,309,411

All other compensation: $6,478,711

Compensation data was collected from SEC filing 10 A/K submitted by the company in January 2020.

With a weekly newsletter looking back at local history.

October 31, 2020 at 08:30PM

https://ift.tt/37ZRonU

Madison-based startup looking to revolutionize computing with a new type of computer chip - Madison.com

https://ift.tt/2RGyUAH

Chips

No comments:

Post a Comment