Could the world run out of new cars?

It seems an absurd question. But an acute shortage of semiconductor chips has prompted equity analysts at investment bank Morgan Stanley to seriously examine the possibility.

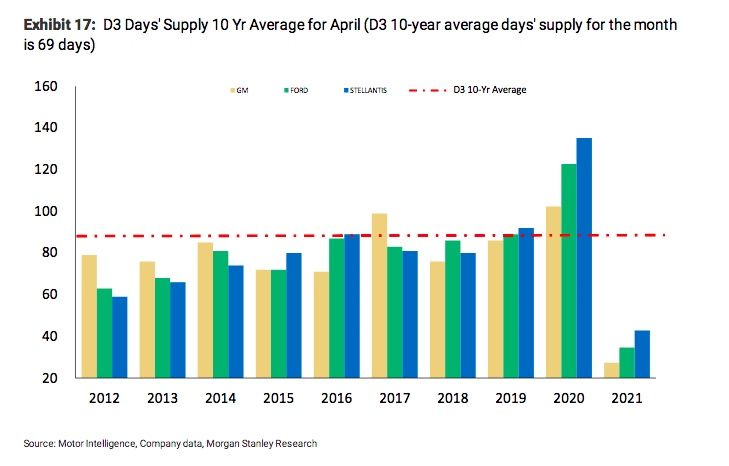

The numbers show it isn’t a silly question at all. According to Morgan Stanley’s research, Ford, General Motors, and Stellantis car inventories are way down on last year thanks to a the combined effect of unexpectedly strong demand for cars and a shortage of chips.

Take General Motors. This time last year the US car maker had enough cars in its inventory to last 102 days. In other words, it could go for more than three months without making any new cars before its stock ran out.

Now, says Morgan Stanley, it has enough to last just 27 days – around a quarter of last year’s number. And the trend appears to be continuing downwards.

Ford’s inventory, meanwhile, is down to 35 days, compared to 123 this time last year; and Stellantis is down 43 days, compared to 135 days last year. The chart below graphically illustrates how bad the situation has become.

It’s the same story across the industry. Morgan Stanley estimates average inventory across all car makers is at record lows of 33 days, down from 39 last month and 120 last year.

“Amid a semi chip shortage,” writes Morgan Stanley analyst Adam Jonas, “the question now turns to whether we potentially run out of cars.”

This week Stellantis, the newly-formed company from the merger of Peugeot and Fiat-Chrysler, warned the chip shortage would get worse in the coming quarter. Volkswagen made a similar warning late last month.

“We are being told from the suppliers and within the Volkswagen Group that we need to face considerable challenges in the second quarter, probably more challenging than the first quarter,” Wayne Griffiths, president of VW’s Spanish brand Seat, told the Financial Times in April.

GM has been a bit more sanguine, telling investors this week that it stood by its profit forecasts. However, it said the chip shortage was prompting it to redirect the dwindling resource to its most profitable cars.

Chief executive Mary Barra called it a “challenging situation” and said the company was “working with the supply base to get every chip we can”.

Stellantis also said it would focus on its most profitable models.

Why the shortage?

The “global chip crunch” began late last year, as car makers were caught by surprise by a sudden rebound in demand for cars after the COVID-19 related lull. At the same time demand for consumer electronics was booming, meaning demand for semiconductor chips, which are used in all sorts of electrical devices, far exceeded supply.

Car makers had come to rely on chipmakers to keep stock in reserve to meet sudden upswings in demand. But because the car makers had told the chip makers demand was low, chip makers had redirected chips to other booming sectors.

This week Infineon, one of the world’s biggest semiconductor chip makers, said demand for chips was “booming” thanks to the energy transition and the digitalisation of the economy.

“Demand greatly exceeds supply for the majority of applications,” Infineon chief exeuctive Reinhard Ploss said.

“Infineon’s manufacturing facilities are running at full speed and we continue to invest in additional capacity. We see bottlenecks in those segments where we depend on chips supplied by foundries, especially in the case of automotive microcontrollers and IoT products. We are doing everything we can to provide our customers with the best possible support in this situation.”

James Fernyhough is a reporter at RenewEconomy and The Driven. He has worked at The Australian Financial Review and the Financial Times, and is interested in all things related to climate change and the transition to a low-carbon economy.

May 07, 2021 at 06:00AM

https://ift.tt/33oNTnm

Chips are down: Why the world could run out of new cars - The Driven

https://ift.tt/2RGyUAH

Chips

No comments:

Post a Comment