Auto bonds have been rallying, led by Ford Motor Co. and General Motors Co., even as some industry giants warn the worst fallout from supply-chain bottlenecks might still be to come.

Corporate bonds issued by Ford F, -0.13%, GM GM, -0.14% and Toyota Motor Corp. TM, +1.53% have caught a bid with debt investors since May 4, ranking among the top-10 most actively traded in the consumer discretionary segment, according to BondCliq.

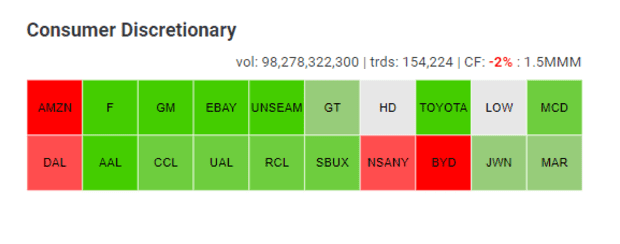

Auto bonds rally since May 4

BondCliqWhile Amazon.com Inc. AMZN, +0.60% debt was the sector’s most active over the same stretch, it’s been hard to find auto bonds not rallying.

Specifically, Ford’s BB+ rated 4.75% bonds due Jan. 2043 were last pegged Friday at a spread of about 224 basis points above Treasurys, by BondCliq, versus around 231 basis point to the start of the week.

Spreads are the level of compensation investors earn on bonds above a risk-free benchmark TMUBMUSD10Y, 1.554%, with less spread often pointing to a more bullish tone among investors.

The auto debt rally comes amid a volatile patch for Ford and GM shares, following first-quarter earnings that smashed Wall Street expectations, despite supply-chain bottlenecks from the pandemic. Those results, at least at Ford, were immediately overshadowed by a potential $2.5 billion hit it expects to take from semiconductor or microchip shortages.

See: Ford’s ‘massive’ first-quarter beat overshadowed by chip-shortage headwinds

But this week Ford shares flirted with a 5 1/2 year high, after May sales data showed soaring demand for SUVs and its electrified vehicles, helping put the stock on pace for a 9.7% weekly gain, according to FactSet.

GM’s stock was nearing a 6.7% weekly gain, after the automaker midweek said it expects first-half 2021 financial results to be “significantly better” than previous guidance, given its “success” in dealing with the semiconductor shortage.

Gains for the big stock U.S. stock benchmarks looked more muted, with the S&P 500 index SPX, +0.88%, the Dow Jones Industrial Average DJIA, +0.52% and Nasdaq Composite Index COMP, +1.47% each on pace for a less than 1% weekly gain.

And after a wobbly few months, debt investors have “looked through supply chain bottlenecks,” despite “the well-documented inflationary cost pressures highlighted” by corporate management teams in first-quarter earnings calls, a Goldman Sachs credit research team led by Lotfi Karoui said in a weekly note.

The team noted that Ford and GM expect peak supply-chain disruptions to occur in the year’s first half, while auto manufactures have responded by shifting “production to vehicles that generate both higher demand and profitability, such as SUVs and pick-up trucks, alongside other changes in processes.”

The pivot is part of the reason for the Goldman team’s recommended overweight for auto bonds.

“This demonstration of operational agility appears to have given investors enough confidence to look through these transitory supply chain disruptions,” they said.

June 05, 2021 at 03:06AM

https://ift.tt/3vP46yG

Shortages of chips and parts aren't denting appeal of auto bonds - MarketWatch

https://ift.tt/2RGyUAH

Chips

No comments:

Post a Comment