chips.indah.link

Huawei is working on plans for a dedicated chip plant in Shanghai that would not use American technology, enabling it to secure supplies for its core telecom infrastructure business despite US sanctions.

Two people briefed on the project said the plant would be run by a partner, Shanghai IC R&D Center, a chip research company backed by the Shanghai Municipal government.

Industry experts said the project could help Huawei, which has no experience in fabricating chips, chart a path to long-term survival.

US export controls imposed in May and tightened in August leverage American companies’ dominance of certain chip-manufacturing equipment and chip-design software to block semiconductor supplies to Huawei.

If it succeeds, it can become a bridge to a sustainable future for their infrastructure business

Industry experts said the planned local facility would be a potential new source for semiconductors after stocks of imported chips Huawei has been accumulating since last year ran out.

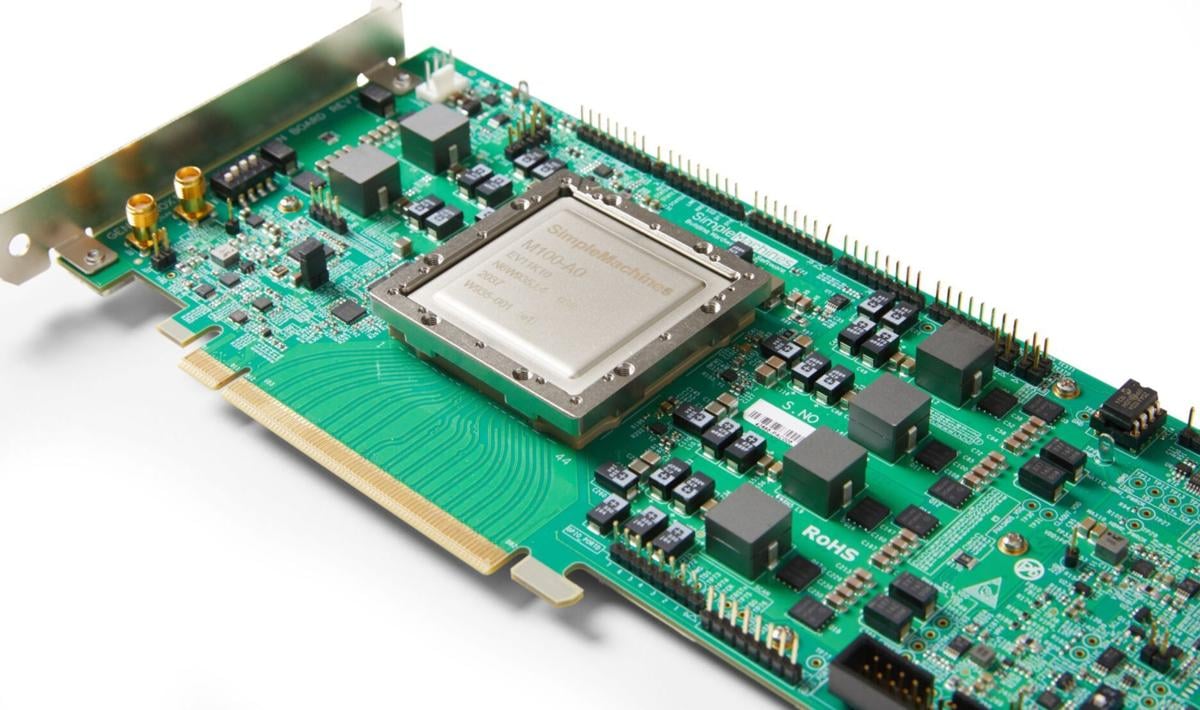

The fabrication plant will initially experiment with making low-end 45nm chips, a technology global leaders in chipmaking started using 15 years ago.

But Huawei wants to make more advanced 28nm chips by the end of next year, according to chip industry engineers and executives familiar with the project. Such a plan would allow Huawei to make smart TVs and other “internet of things” devices.

Huawei then aims to produce 20nm chips by late 2022, which could be used to make most of its 5G telecoms equipment and allow that business to continue even with the US sanctions.

“The planned new production line will not help with the smartphone business since chipsets needed for smartphones need to be produced at more advanced technology nodes,” said a semiconductor industry executive briefed on the plans.

“But if it succeeds, it can become a bridge to a sustainable future for their infrastructure business, in combination with the inventory they have built and which should last for two years or so,” he said.

“They possibly can do it, in maybe two years,” said Mark Li, a semiconductor analyst at Bernstein in Hong Kong.

He added that while the chips Huawei needed for making mobile network base stations would ideally be made on 14nm or more advanced process technology, using 28nm was possible.

“Huawei can make up for the shortcomings on the software and system side,” he said. Chinese producers could tolerate higher costs and operational inefficiencies than their offshore competitors.

The project, first reported by Chinese newspaper Caixin last month, could also jump-start China’s ambitions to shake off its dependency on foreign chip technology, particularly from the US, which wants to slow China’s development as a technology power.

Huawei has already been investing in the domestic semiconductor sector, especially among smaller operators, a chip industry executive said.

“Huawei has strong abilities in chip design, and we are very happy to help a trustworthy supply chain develop its capabilities in chip manufacturing, equipment and materials. Helping them is helping ourselves,” rotating chairman Guo Ping told journalists in September.

According to chip engineers and industry executives, Huawei plans to eventually equip its domestic production exclusively with Chinese-made machinery. But analysts caution that such a goal is several years away.

“Such a facility would most likely run on a combination of equipment from different Chinese suppliers such as AMEC and Naura, plus some used foreign tools which they can find in the market,” Mr Li said.

He added that manufacturing chips in such an environment would be less efficient and more costly. But Huawei could afford this because the volume of the semiconductors needed for base stations was much lower than for a mass product like smartphones.

Huawei and ICRD declined to comment on the plans for the production facility.

“You will not obtain any information from us here, we cannot give you anything,” said Huang Yin, an ICRD spokeswoman. “This is rather sensitive.”

A major shareholder of ICRD is state-owned Huahong Group, which also controls contract chipmakers Huahong Grace and HLMC.

The Link Lonk

November 01, 2020 at 07:01AM

https://ift.tt/3oMgble

Huawei develops plan for chip plant to help beat US sanctions - Financial Times

https://ift.tt/2RGyUAH

Chips